Welcome to our detailed guide on changing your tax class in Germany for the year 2025!

Navigating the complexities of the German tax system can significantly influence your financial outlook, particularly for both residents and expatriates. This article aims to clarify the intricacies of tax classes in Germany, explore the motivations for adjusting your tax class, and furnish you with a detailed walkthrough on how to effect this change seamlessly.

Changes in your marital status, such as marriage or divorce, or other significant life events, can necessitate a reevaluation of your tax classification. Understanding how to optimize your tax class is an essential step in managing your finances more effectively. Join us as we explore how to take control of your fiscal responsibilities in Germany, ensuring you’re well-prepared to adjust your tax class with ease and precision.

When Are You Required to Change Your Tax Class?

When Do I Have To Change My Tax Class?

In Germany, a change in your tax class becomes necessary when there are significant changes in your family circumstances, such as marriage or divorce. Upon notifying your local city hall (Rathaus) of these changes, they automatically relay this information to the German Tax Office (Finanzamt).

Reasons for Changing Your Tax Class:

- Marriage: Typically, after getting married, you are eligible to switch to Tax Class 4. However, if there is a considerable disparity in earnings between the spouses, opting for a combination of Tax Class 3 (for the higher earner) and Tax Class 5 (for the lower earner) might be more beneficial. This adjustment allows for a more balanced tax deduction from each spouse’s income, potentially lowering the overall tax burden.

- Separation/Divorce: A separation or divorce necessitates a change in your tax class. Individuals who do not have children, or do not have full custody of their children, generally move to Tax Class 1. Conversely, if you are a single parent with sole custody of your children, you would qualify for Tax Class 2.

- Death of a Spouse: The passing of a spouse leads to a temporary assignment to Tax Class 3 for the following two years. After this period, the tax class will need to be adjusted to Tax Class 1 or 2, depending on the specific family circumstances.

- Birth of a Child with Sole Custody: If you become a single parent with sole custody following the birth of a child, your tax classification shifts to Tax Class 2, acknowledging the increased financial responsibility.

These transitions in tax class are designed to adapt to your changing fiscal needs and responsibilities, ensuring that your tax contributions are as fair and accurate as possible.

How to Update Your Tax Class Following Marriage?

How to Change your Tax Class after Marriage?

Once you’re married, it’s essential to register your union at the local City Registration Office (Bürgeramt or Rathaus). Upon registering your marriage at the Rathaus or Standesamt, they will automatically notify the German Tax Office (Finanzamt) of the change in your marital status. Following your marriage, the Finanzamt typically updates both spouses’ tax class to Tax Class 4 by default. This classification applies regardless of whether one spouse is unemployed or earns significantly less than the other.

For couples who prefer a different tax arrangement, there is an option to switch between Tax Classes 3 and 5. This switch is advisable if one spouse earns at least 60% of the total household income, optimizing the tax benefits and burdens between the two. To facilitate this change, a couple needs to submit a specific form available through the Finanzamt. Notably, since 2020, couples have been allowed multiple opportunities within the same year to adjust their tax classes—a significant update from the previous rule that permitted only one change per year. This flexibility allows couples to respond more dynamically to changes in their financial circumstances throughout the year.

How Can I Change My Tax Class?

Changing your tax class in Germany as a married couple is a straightforward process, requiring minimal bureaucratic effort. Here’s how you can manage this change efficiently:

- Complete the Required Form: Start by filling out the “Antrag auf Steuerklassenwechsel bei Ehegatten,” which is the form for a tax class change for married couples.

- Save and Print the Form: Once filled, save the form as a PDF file. Then, print a hard copy of the completed form.

- Signatures: Both spouses must sign the printed form to validate the change request.

- Submit to the Finanzamt: Send the signed form to the tax office (Finanzamt) that is responsible for your area.

Once you opt for Tax Classes 3 and 5, it’s important to note that you are then required to file a joint tax declaration at the end of the fiscal year. This joint filing is mandatory and ensures that your taxes are assessed correctly based on the combined income of you and your spouse, optimizing potential tax benefits.

Guide to Filling Out the “Antrag auf Steuerklassenwechsel bei Ehegatten” Online Form

Completing the “Antrag auf Steuerklassenwechsel bei Ehegatten” form is essential for married couples in Germany who wish to change their tax class. Below is a step-by-step guide to help you accurately fill out this form:

Field 1 – Steuernummer: Enter your tax number, which can be found on your tax assessment (Steuerbescheid) if you have previously made a tax declaration. If you cannot locate it, you may leave this field blank.

Field 2 – An das Finanzamt: Write the name of your responsible tax office or the name of your city.

Field 3 – Bei Wohnsitzwechsel: bisheriges Finanzamt: If you have moved, enter the name of your former tax office here.

Field 5 – Identifikationsnummer (IdNr.): Enter the Tax ID of the partner who is filing this request. This number is typically found on your salary slip.

Fields 5-6 – Name & Vorname: Enter the last name and first name of the partner who is filing the request.

Fields 6-9 – Straße, Hausnummer, Postleitzahl & Wohnort: Provide your street address, house number, postal code, and city.

Field 10 – Various Events (Married, Widowed, Divorced, Separated): Indicate the date of the event relevant to your situation:

- Married since

- Widowed since

- Divorced since

- Permanently separated since

Field 11 – Identifikationsnummer (IdNr.): Enter the Tax ID of the other partner.

Fields 12-15 – Name, Vorname, Straße, Hausnummer, PLZ, Wohnort: List the last name, first name, street, house number, postal code, and city of the other partner (if different from the fields above).

Field 17 – Bisherige Steuerklassenkombination: Tick the current tax class combination for you and your spouse, typically IV/IV if this is your first time changing.

Field 18 – Ich / Wir beantrage(n) die Steuerklassenkombination: Select the desired tax class combination for you and your spouse based on your financial arrangement.

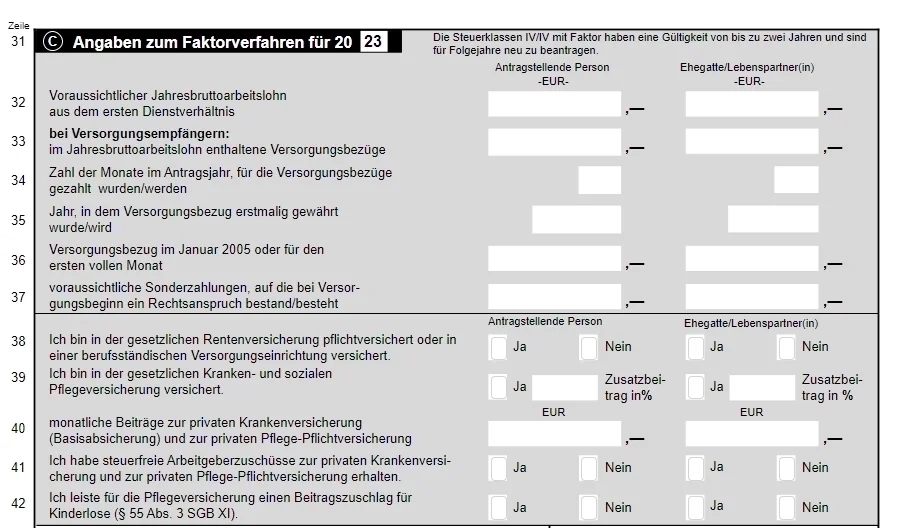

Fields 31-42 – Angaben zum Faktorverfahren für 20__: This section, pertaining to factor procedures for a specific year, can typically be left blank unless specifically applicable.

Field 43 – Signatures Required: Both spouses must sign the form, with the partner initiating the request signing first.

This guide should help you navigate the process of changing your tax class through the “Antrag auf Steuerklassenwechsel bei Ehegatten” form, ensuring all necessary details are correctly provided to the Finanzamt.

Guide to Filling Out the “Antrag auf Steuerklassenwechsel bei Ehegatten” Using Elster

If you’re looking to change your tax class in Germany through Elster, it’s essential to first ensure you have an Elster account set up. Here’s a step-by-step guide to help you navigate the online form:

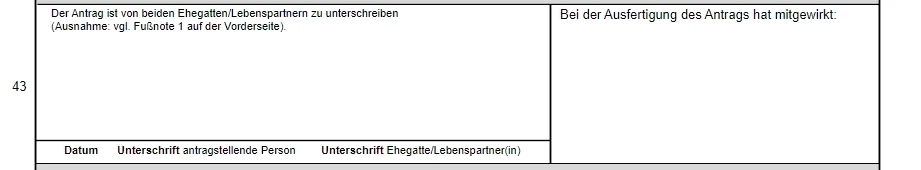

Step 1: Access the Form

- Log into your Elster account.

- Navigate to “Formulare & Leistungen” and search for “Wechsel” to find the form for “Antrag auf Steuerklassenwechsel”.

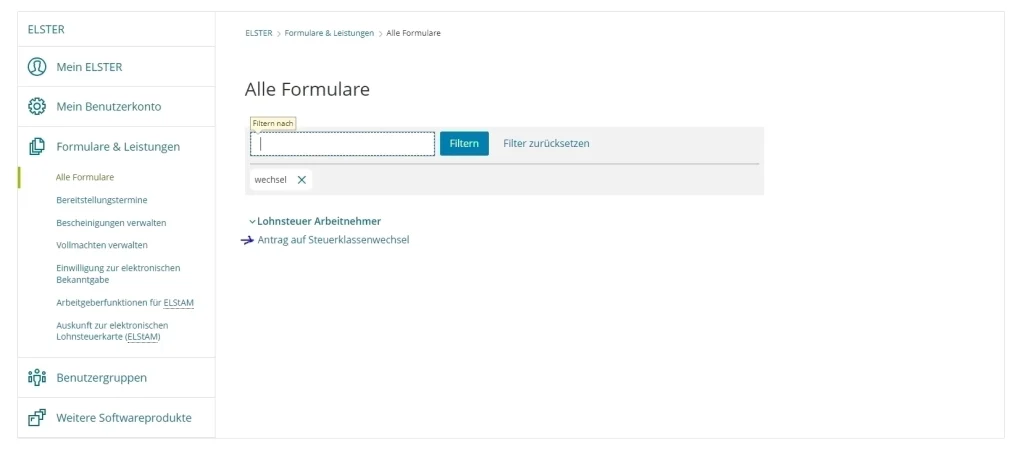

Step 2: Select the Year

- Choose the current year for which the tax class change is applicable, for instance, 2025.

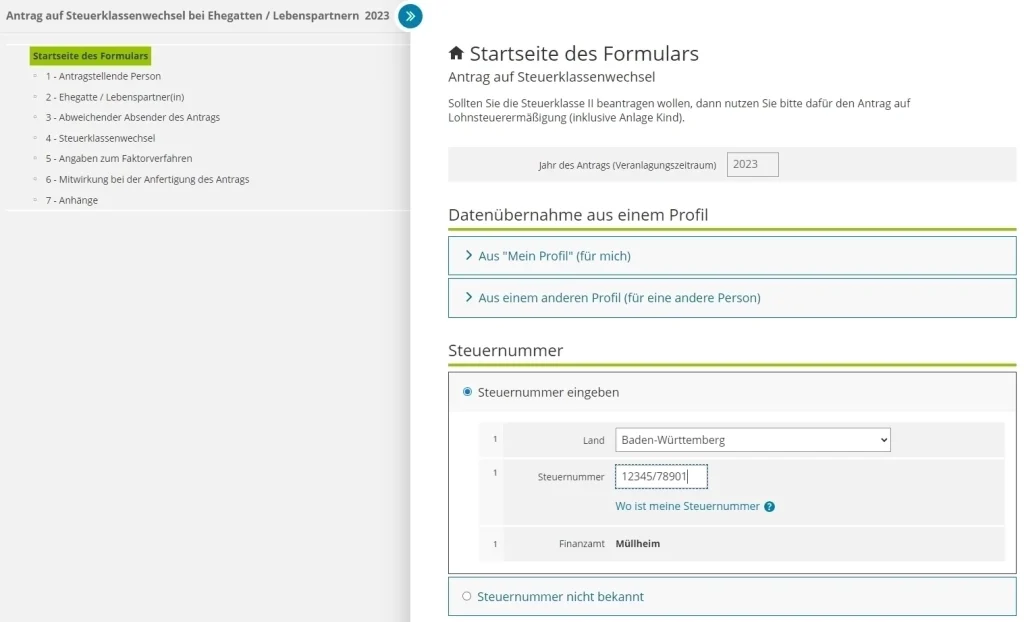

Step 3: Steuernummer and Finanzamt

- Enter your state and the 10-digit Steuernummer (Tax number). The system will automatically assign the responsible Finanzamt based on your location.

- Proceed to the next page by clicking “Nächste Seite”.

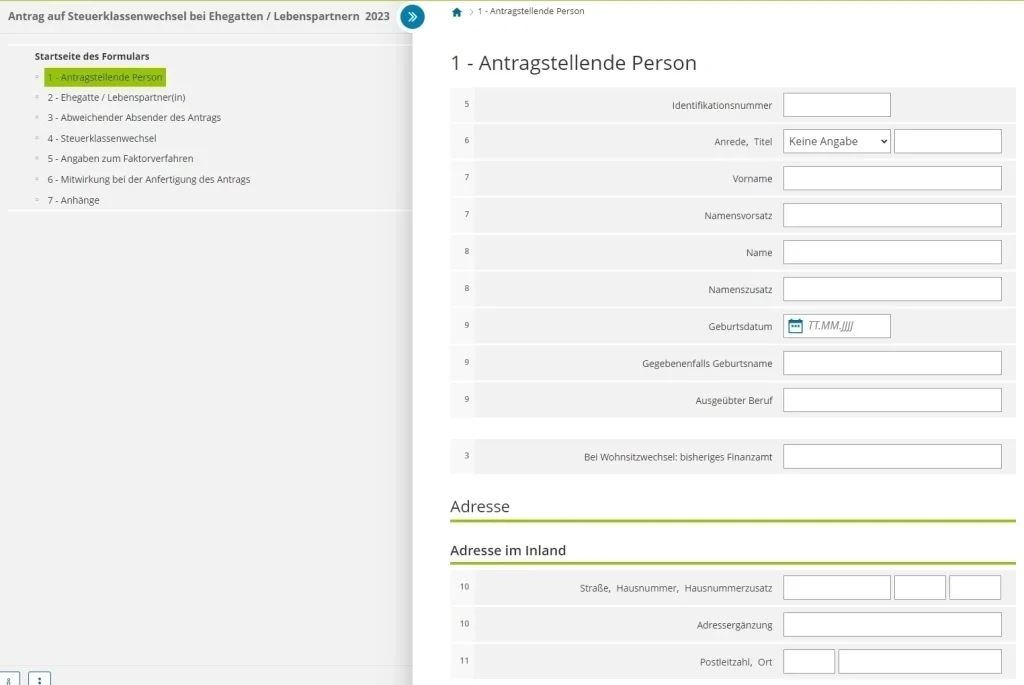

Step 4: Applicant Information

- Field 5: Enter the Tax ID (Identifikationsnummer) of the applicant, which can be found on any salary slip.

- Fields 7-8: Input the applicant’s last name and first name.

- Field 9: Provide the applicant’s date of birth, previous name if applicable (e.g., due to marriage), and profession.

Field 3: List your previous Finanzamt if you have recently moved.

Address Details (Applicant)

- Fields 6-9: Enter the applicant’s street, house number, postcode, and city.

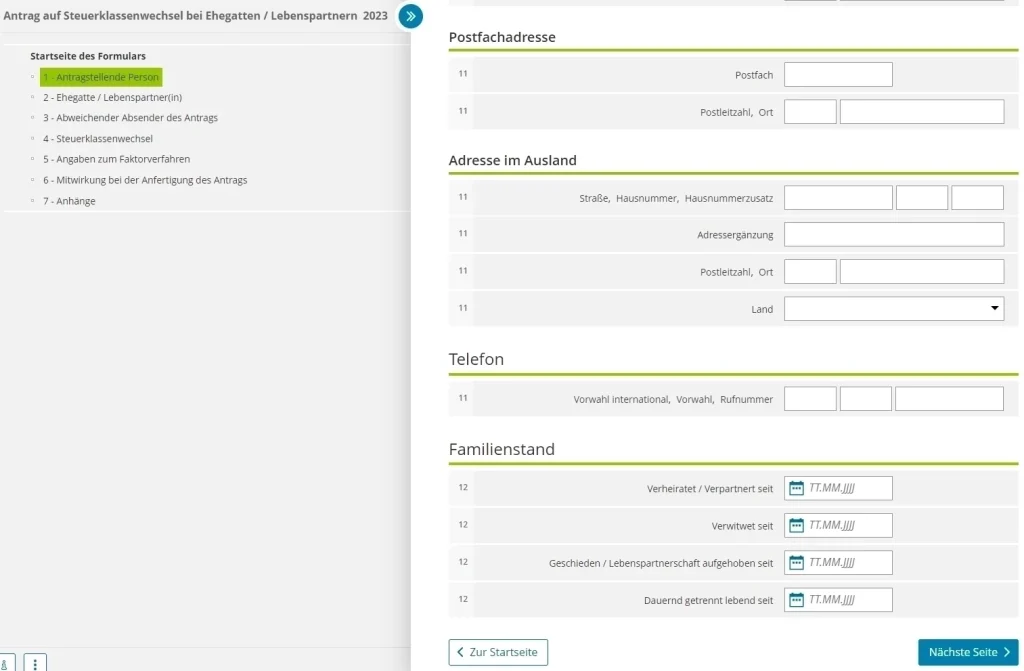

Marital Status Changes

- Specify the date related to your marital status change:

- Married since

- Widowed since

- Divorced since

- Permanently separated since

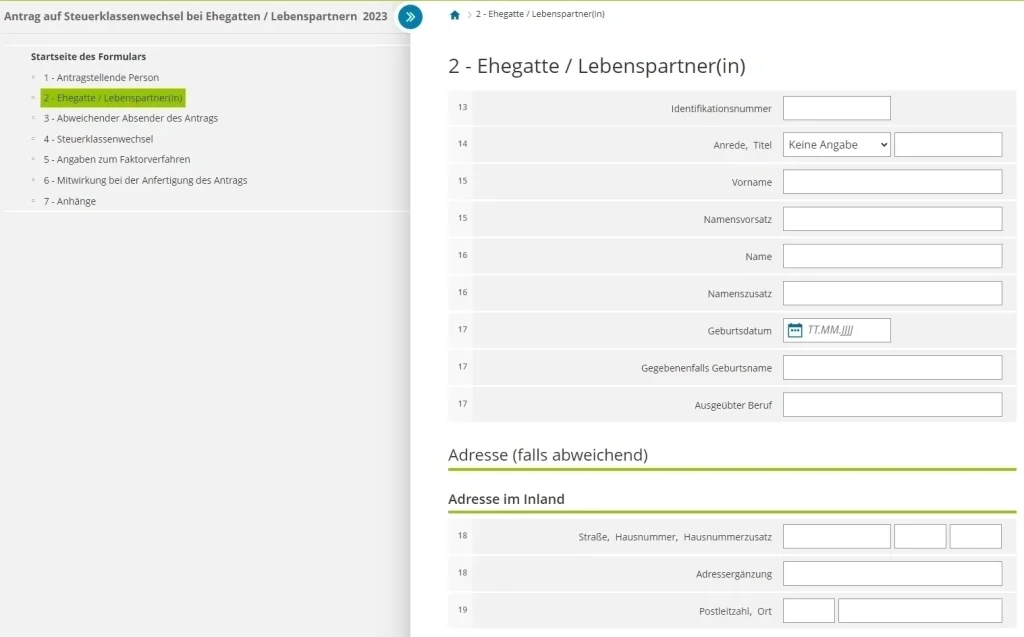

Step 5: Spouse Information

- Field 13: Spouse’s Tax ID (leave blank if unavailable).

- Fields 15-16: Spouse’s last name and first name.

- Field 17: Spouse’s date of birth, previous name if applicable, and profession.

Spouse’s Address (if different)

- Fields 18-19: Enter the spouse’s street, house number, postcode, and city if they live in a separate household.

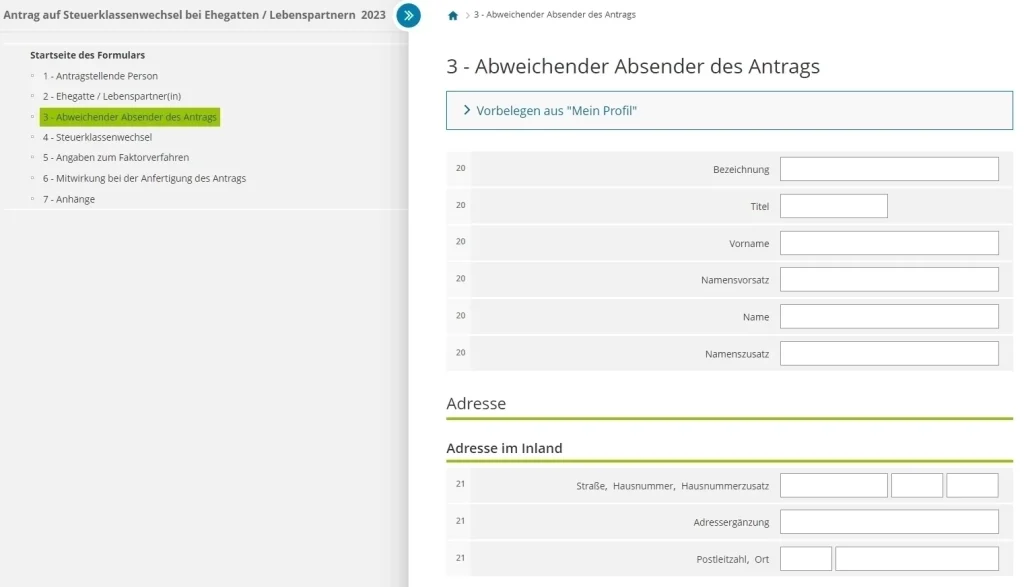

Step 6: Sender Information

- This section is generally used by tax consultants; if you are filling out the form yourself, leave this empty.

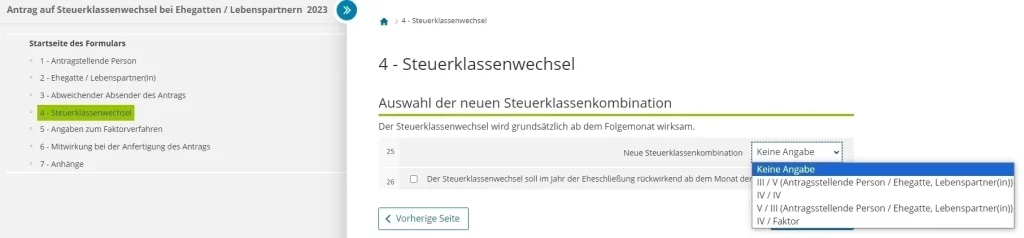

Step 7: Tax Class Selection

- Dropdown 25: Select the new tax class combination.

- Checkbox 26: Check this if you want the tax class change to apply retroactively to the date of your marriage or another significant event.

Step 8: Factor Method Details

- If applicable, provide details for calculating the tax class with a factor. This is important if both partners are earning.

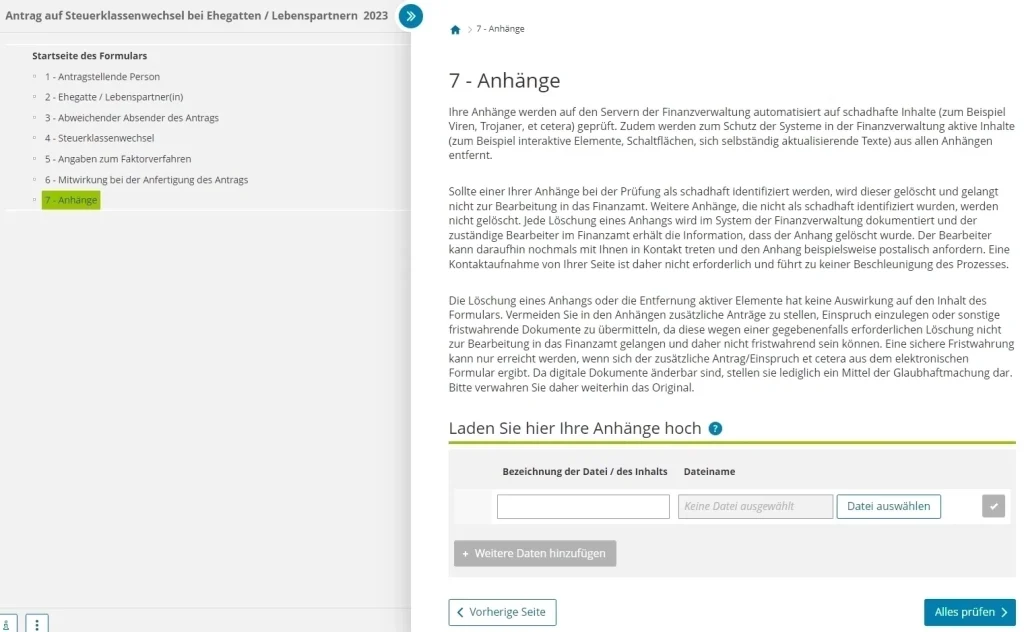

Step 9: Participation and Attachments

- This section is for tax consultants or if you need to attach supporting documents, like a marriage certificate.

Step 10: Review and Submit

- Use the “Alles prüfen” button to check for any errors or missing fields. Review all entries thoroughly.

- Once verified, submit the form for a paperless solution to change your tax class via Elster.

By following these steps, you can efficiently manage your tax class change in Germany through the Elster platform, ensuring all details are correctly captured for your new fiscal status.

Conclusion

In Germany, your tax class is significantly influenced by your marital status. The opportunity to select or change your tax class primarily arises after marriage, which allows couples to potentially optimize their tax benefits based on their combined incomes.

Opting for a specific tax class configuration, such as the switch between Tax Class 3 and 5, can offer temporary financial relief in monthly income taxes. However, it’s important to remember that despite these interim benefits, the total annual income tax liability remains unchanged.

This system is designed to facilitate fair tax payments while considering the varied financial situations of married couples. By understanding and strategically choosing your tax class, you can manage your fiscal responsibilities more effectively throughout the year.